It’s been a wild year for Argentina: a World Cup victory, 100%+ inflation, and political polarization have produced a rollercoaster of emotion for South America’s third largest country. As if that wasn’t enough, Friday morning saw another tumultuous turn for Argentina: Judge Preska issued a summary judgement opinion in the YPF case, ruling almost entirely in Plaintiffs’ (Petersen and Eton Park) favor. The decision comes nearly a year after the parties filed their respective motions for summary judgment.

But before we go into the victory lap and discussion of what it means for BUR 0.00%↑ price action in the coming weeks and months, it’s important to take a moment to humble myself: while the outcome is in line with my predictions, I got the timing of this one way wrong. We knew this opinion was going to take a while. We knew the opinion itself would be long. What I didn’t expect was a ruling 351 days after Plaintiffs’ filed their original motion for SJ. Similarly, I anticipated an earlier outcome of the LQDA 0.00%↑ PTAB rehearing request. There is likely one major reason I’ve been anticipating earlier resolution to some of these things—the last case I ever litigated was in October of 2020. Since then, Covid backlogs have been working their way through the judicial system and have caused dockets to get pushed out. Nevertheless, it’s something I’m aware of and aim to be better at projecting moving forward.

Now…

Recall Burford Capital, a publicly-traded litigation finance firm, owns a substantial portion of the Petersen and Eton Park claims. These claims relate to two entities’ (Petersen and Eton Park) respective ownership stakes in Argentina’s Exxon-equivalent, YPF. After years of litigation, the parties filed cross-motions for summary judgment last spring, with Petersen and Eton Park asking the court to declare YPF and Argentina breached their contractual duties under the YPF bylaws relating to Argentina’s expropriation of YPF shares, and Argentina asking the court to dismiss these claims.

Question #1: What did the SJ ruling resolve?

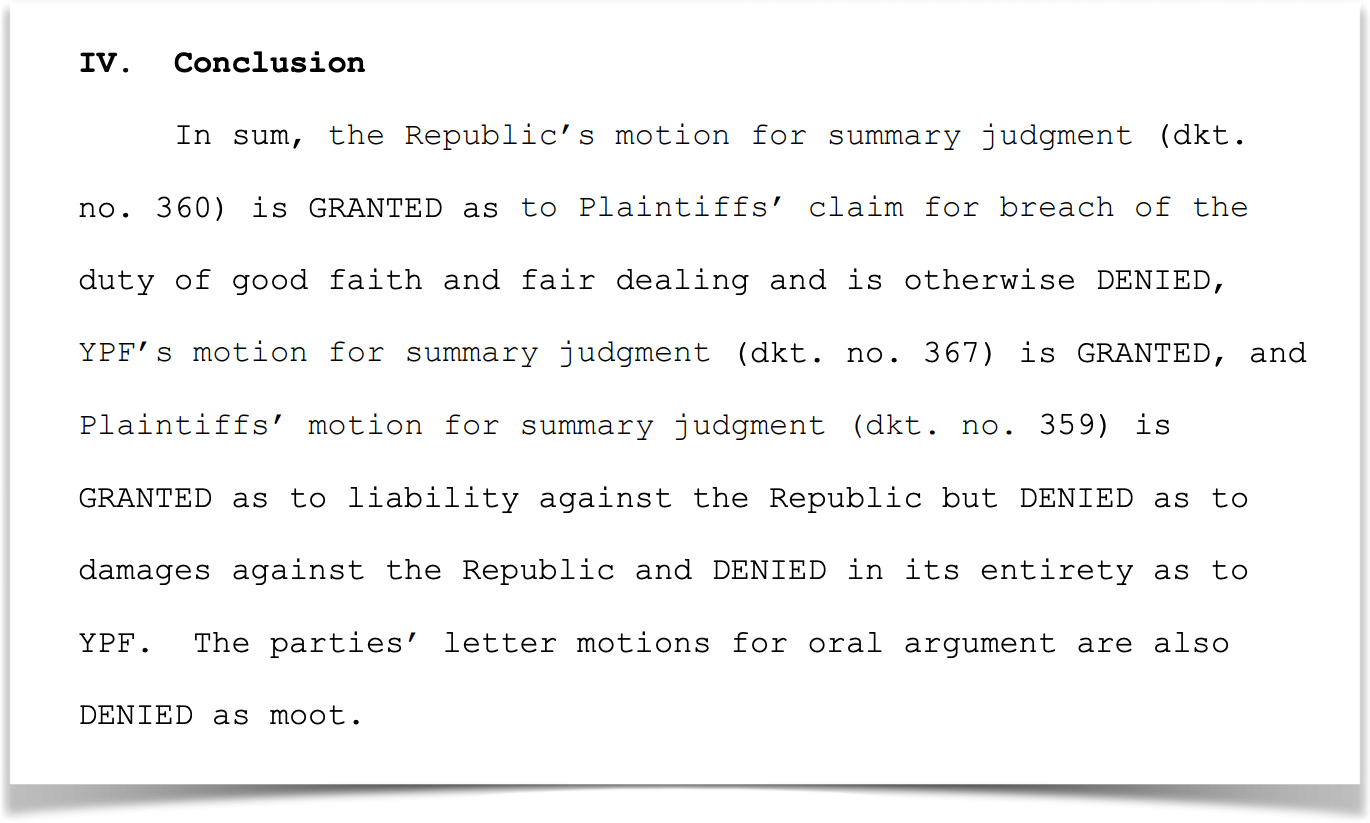

The summary judgment ruling knocked out most of the issues in the case.

Plaintiffs’ motion for summary judgment was granted as to Argentina’s liability for breach of contract/anticipatory breach of contract.

Upon first glance, it looks like Argentina got a win, with their motion for summary judgment being granted as to the good faith and fair dealing claims; however these were really a backstop argument for Plaintiffs, and therefore immaterial to the outcome now that the breach of contract claims have been decided.

YPF got dismissed entirely, which looks like a loss for Plaintiffs, except damages would have been payable by Argentina anyway (in the same amount), so it’s actually a moot point.

Perhaps most notably, the court ruled that a judgment would not be valued in pesos as of the date of the breach of contract. This is particularly important because the graph of Argentine inflation looks like the front face of Mt. Everest. Any payment in pesos would have wiped out Plaintiffs’ winnings:

Question #2: What did the SJ ruling NOT resolve?

The outcome largely hinges on one remaining issue: what was the notice date of Argentina’s breach of contract?

Possible dates range from January 27, 2012 to April 16, 2012, with Plaintiff’s suggested date of notice being the counterfactual February 13, 2012 (the date Argentina should have provided notice of its intent to acquire a sufficient number of shares to trigger Section 7(f)(i) of the bylaws prior to acquiring those shares, had Argentina not breached).

Question #3: What are the Petersen and Eton Park claims worth?

As we just discussed, the value of the claims is contingent on the notice date.

This might all seem like a matter of semantics, but the notice date actually has a significant impact on the ultimate award, as the formula used to calculate damages is tied to price/income ratios for the stock related to notice date. I won’t go through the various possible calculations, as the below excerpt from Focus Capital Management (found here) shows the work on the Petersen claims:

We’ll just say low end is $6B, and high end is $9B as our bookends for the value of the Petersen claims. Add the extra 25% for the Eton Park claims and we get to total claim value bookends of $7.5B and $12B.

Question #4: How much of the judgment will Burford take home?

Around 45%.

How do we get to this number? I’m not going to walk through all the math, as it’s been done before. Again, the below excerpt from Focus Capital Management is instructive:

Question #5: What about Pre-Judgment Interest?

If you’ll recall from our Twitter merger discussion days, there was a lot of talk of pre-judgment interest (PJI) as the deal neared to a close, as even a small interest rate would have caused Mr. Musk millions of dollars in heartburn every day he failed to close the transaction.

We encounter the same issue here, and the numbers are even more staggering due to the amount of time that has passed since the case was filed. PJI has been accruing since the breach in early 2012.

Here, the appropriate PJI interest rate is likely between 6-8%. The Court agreed that the commercial rates applied by Argentinian courts was the appropriate PJI rate; however the Court failed to decide what rate that was. Importantly, the Court did not say that 6-8% was the correct range either. This range was supplied by Plaintiffs. Rather, the Court merely said that an Argentinian commercial rate is appropriate where the case involves purely “commercial obligations.” Consequently, our outcome could apply a lower rate. In cases likely these where interest has accrued for so long, judges are often skeptical of awarding high PJI rates. This is a little more “finger in the wind” than science, and so in my outcomes table* below I have simply assumed that worst case scenario for PJI is half of the low-end of Plaintiffs’ proposed range.

So my rudimentary worst-case (read: megabear) scenario puts the value of BUR’s entitlements at ~$21.75/share, and best case puts it at ~$58.50/share. I think there is approximately 0% chance Plaintiffs get 8% PJI, but I’ll say it again—I’ve been wrong before.

The most likely practical outcome is a settlement where this gets paid out at half of face value over the course of 5 years, or full value over the course of 10 years, or something along those lines. It’s impossible to guess accurately right now, but even half of the mega-worst-case scenario adds over $10/share to BUR’s market cap. In light of that, I still stand by my comment on Friday:

Question #6: How will this actually get resolved / What about appeal?

In big civil cases, there’s always a mediator trying to get the parties to settle and free up judicial resources for the next case. Mediation is not required, but it’s a sign of good faith that you’re working towards a resolution. Judges and their court time are limited resources, so it’s usually a good idea to participate earnestly—or at least ostensibly earnestly. This mediator is in contact with both sides. Sometimes there are multiple mediators.

When you win a big summary judgment ruling, or when you win a trial, you usually get a text message from your mediator about 30 second later that looks something like this:

So my guess is that Burford got a text or a call or a Facetime or a carrier pigeon from their mediator on Friday mid-day saying “Yes, ‘billions’ with a ‘B’” or something along those lines.

One thing is clear: Judge Preska wants this off her docket.

So we’ll know by April 14 what to expect. I suspect the actual filing will be something along the lines of “The parties are meeting and conferring in good faith and request an additional 30 days to determine if settlement is appropriate. Should the parties not reach resolution, we propose a hearing for the Court to hear additional evidence on the issue of notice date so that it may make a final decision and allow us to appeal, if needed.”

The less likely options are (1) “we’ve already settled, and Burford is poppin’ bottles,” and (2) “Argentina says go f*** yourself and we’re going to trial on the issue of notice date.”

As for appeal, with this much money on the line, it is almost guaranteed. Argentina would also have to post a bond, so that would, in some ways, take care of collection risk discussed below. But when you get this ruling at the summary judgement stage, rather than at trial, the prospect of a win on appeal is tougher for Argentina. There are simply fewer avenues of attack—no biased jurors, no exhibits which were mistakenly presented, etc. My thought is that settlement makes sense for Argentina, though given the Second Circuit appellate timelines are probably >1 year right now, we likely won’t see a settlement for some time, as Argentina is unlikely to settle without getting at least some kind of read on appellate outcome. It’s also entirely possible Argentina chooses to swing for the fences and let the appellate process fully play out.

Question #7: What if Argentina doesn’t pay?

It’s a fair question. Whether Argentina wants to continue to battle this out or settle immediately, why should they make good on their debts? After all, if people think Elon Musk can ignore a judgment, why can’t an entire country??

Elon Musk, of course, did not ignore the Delaware Chancery, but that was largely due to the fact that Musk’s assets are (broad strokes here) Delaware assets. Courts can seize assets to satisfy judgments, so it’s generally best not to give the bird to the court that sits in the same jurisdiction as the assets you care the most about. In Musk’s case, ignoring a Delaware court would have been a very, very bad idea.

But the Southern District of New York is not in Argentina. It’s in New York. And New York is in the United States. If you got a speeding ticket in say, the Netherlands, you might simply not pay that speeding ticket and never return to the Netherlands. Stroopwafels aren’t that great, anyway. In the same vein, and as far as I know, Argentina isn’t planning on visiting the United States. It would be a tectonic and logistical nightmare.

However, Argentina does have assets within the U.S.’s reach. Argentina has things like cash deposits in U.S. banks and ADSs which trade on American exchanges and these things are mostly fair game when it comes to the reach of U.S. courts.

It’s important to note there are some limitations to this rule. A U.S. court has previously ruled that judgment creditors could not seize assets of the Argentinian central bank. These limitations are important when you realize that $10-28B (rough maths) is a lot of money. It’s especially a lot of money when your GDP is less than $500B.

Still, Argentina has a history of paying large, foreign judgments, albeit reluctantly.

Additionally, it’s worth mentioning that regardless of this SJ outcome, Burford has done quite well on its YPF-related investment. The Petersen-related entitlements produced $236mm in cash proceeds after Burford sold stakes in the litigation to other entities—not bad considering Burford paid just $18mm for the Petersen assets back in 2015 and $26mm for the Eton Park assets. I say this not as a relevant metric of valuation but rather as an endorsement of the business model. Burford has demonstrated that litigation financing can yield significant returns and provide ample opportunities for de-risking along the way.

I substantially increased my BUR 0.00%↑ position on Friday when the stock unhalted following the news. I see this hitting $15 in the very near term, and realistically at least $25 within two years, though these numbers could get much higher based on the table provided. It's also likely a huge windfall would get dividended out to shareholders given the disproportionate size of a potential award relative to market cap and historical investments.

Thanks to everyone who reached out on Twitter!

I tend to think excellent writing reflects an author who has really spent time thinking about an issue and gotten to the crux of the matter, and you have done that in spades. Thank you. And, fwiw, this made me laugh and makes a good point at the same time: "In the same vein, and as far as I know, Argentina isn’t planning on visiting the United States. It would be a tectonic and logistical nightmare."

What if Argentina doesn’t pay? We take their ships.